Munich Re: “3x growth estimated in cyber crime costs over the next 4 years”

As cyber attacks continue to grow in sophistication and frequency, cyber insurers are expecting their market to double in the next two years.

I’ve spent a lot of time here on this blog educating you on attack specifics, industry trends, and the impacts felt by attacks.

I’ve also talked quite a bit about cyber insurance and the recent trends. But seldom have we been able to combine the two and present the state of cyber attacks from an insurer’s perspective.

Ransomware by far the leading cause of cyber insurance losses

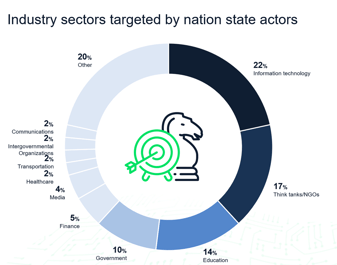

Cyber Insurer Munich Re recently released their Cyber insurance: Risks and Trends 2023 report which provides us with some insight into the state of attacks and the impact on cyber insurance. According to the report: “ransomware was, by far, the leading cause of cyber insurance losses”, making it primarily responsible for the projected massive growth in cyber insurance – which is estimated to have been a market size of $11.9 billion in 2022 and projected to reach $33.3 billion by 2027.

“3x growth estimated in cyber crime costs over the next 4 years”

There’s a 3x growth estimated in cyber crime costs over the next 4 years and a 3x growth in the cyber insurance market in the same timeframe. This means that organizations should expect both a rise in the frequency of attacks in the coming years, as well as an increase in the cost of cyber insurance. Rises in insurance costs should be a clear indicator that spending budget on prevention methods (that include security awareness training) is far better than putting all your eggs in the cyber insurance basket.

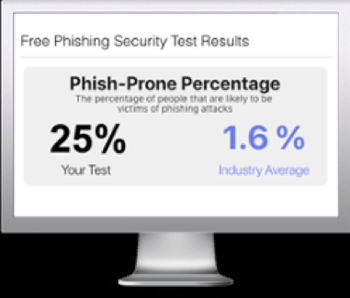

Free Phishing Security Test

Would your users fall for convincing phishing attacks? Take the first step now and find out before bad actors do. Plus, see how you stack up against your peers with phishing Industry Benchmarks. The Phish-prone percentage is usually higher than you expect and is great ammo to get budget.

Here’s how it works:

- Immediately start your test for up to 100 users (no need to talk to anyone)

- Select from 20+ languages and customize the phishing test template based on your environment

- Choose the landing page your users see after they click

- Show users which red flags they missed, or a 404 page

- Get a PDF emailed to you in 24 hours with your Phish-prone % and charts to share with management

- See how your organization compares to others in your industry

PS: Don’t like to click on redirected buttons? Cut & Paste this link in your browser: https://info.knowbe4.com/phishing-security-test-partner?partnerid=001a000001lWEoJAAW